All Categories

Featured

Table of Contents

- – What Makes Voluntary Term Life Insurance Unique?

- – Why You Need to Understand Term Life Insurance...

- – How Does Level Premium Term Life Insurance Po...

- – What is Direct Term Life Insurance Meaning? F...

- – What Are the Benefits of Voluntary Term Life...

- – What is What Is Level Term Life Insurance? Q...

If George is diagnosed with a terminal health problem during the initial plan term, he most likely will not be qualified to restore the plan when it ends. Some policies supply guaranteed re-insurability (without evidence of insurability), however such attributes come at a greater expense. There are several types of term life insurance.

Normally, most companies supply terms varying from 10 to 30 years, although a few offer 35- and 40-year terms. Level-premium insurance policy has a fixed month-to-month payment for the life of the policy. A lot of term life insurance policy has a level costs, and it's the type we've been referring to in most of this write-up.

Term life insurance policy is eye-catching to youths with youngsters. Parents can acquire substantial insurance coverage for a low expense, and if the insured passes away while the plan holds, the family members can count on the survivor benefit to change lost revenue. These policies are additionally appropriate for individuals with growing households.

What Makes Voluntary Term Life Insurance Unique?

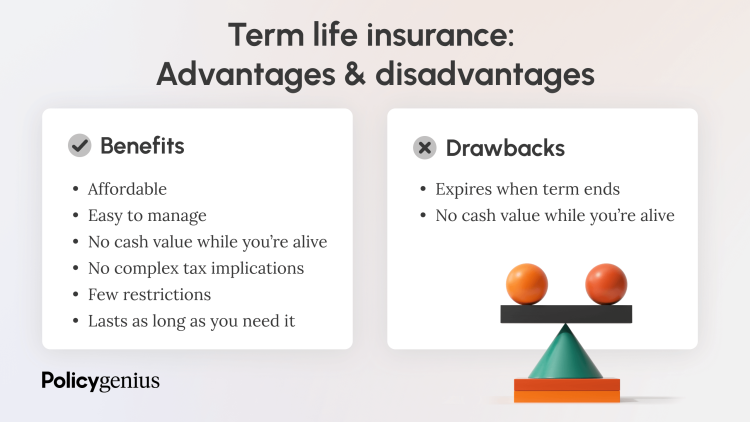

Term life policies are optimal for individuals who want considerable coverage at a reduced price. People who possess whole life insurance pay much more in costs for less coverage yet have the safety of recognizing they are protected for life.

The conversion motorcyclist ought to enable you to convert to any type of permanent plan the insurance policy company provides without restrictions. The main functions of the biker are preserving the original wellness ranking of the term plan upon conversion (also if you later have wellness issues or come to be uninsurable) and choosing when and just how much of the protection to transform.

Of course, total costs will certainly boost substantially considering that whole life insurance coverage is extra costly than term life insurance coverage. Medical conditions that develop throughout the term life period can not cause premiums to be enhanced.

Why You Need to Understand Term Life Insurance Level Term

Entire life insurance coverage comes with substantially higher regular monthly costs. It is meant to supply insurance coverage for as long as you live.

It relies on their age. Insurance coverage companies established an optimum age restriction for term life insurance policy policies. This is generally 80 to 90 years old yet might be higher or reduced depending upon the business. The premium likewise rises with age, so a person aged 60 or 70 will pay substantially greater than a person decades younger.

Term life is somewhat similar to vehicle insurance. It's statistically unlikely that you'll require it, and the premiums are money away if you don't. If the worst occurs, your family will receive the advantages.

How Does Level Premium Term Life Insurance Policies Work?

Generally, there are 2 sorts of life insurance policy strategies - either term or irreversible strategies or some combination of both. Life insurance companies use various types of term plans and typical life policies in addition to "passion delicate" items which have become more common given that the 1980's.

Term insurance offers security for a specific amount of time. This period can be as brief as one year or offer protection for a certain variety of years such as 5, 10, two decades or to a defined age such as 80 or in many cases as much as the oldest age in the life insurance coverage death tables.

What is Direct Term Life Insurance Meaning? Find Out Here

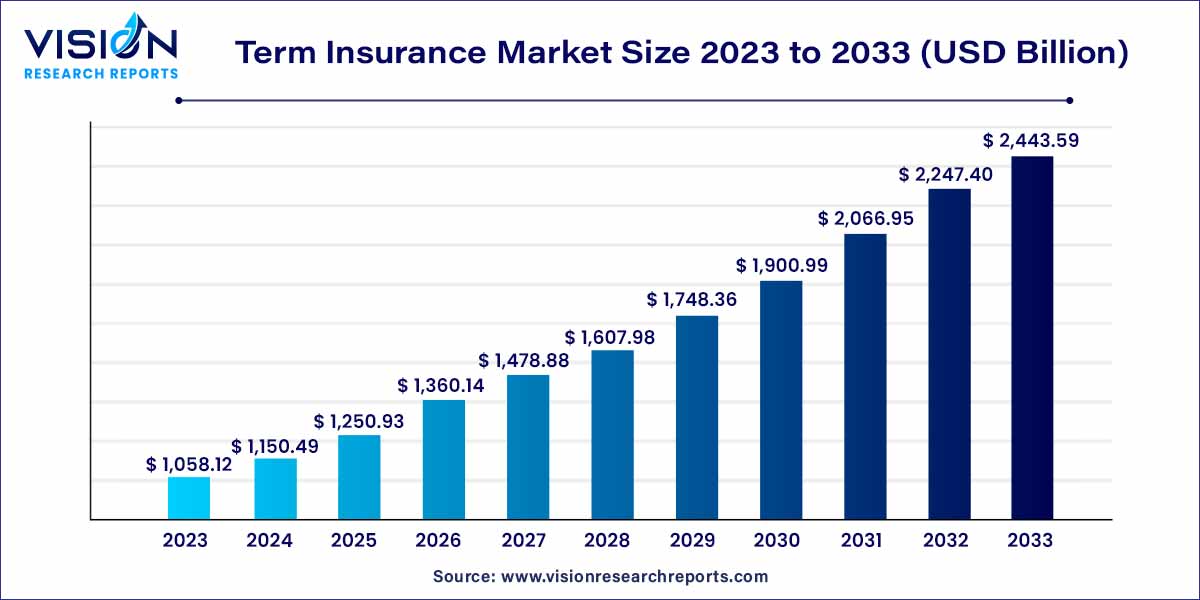

Currently term insurance coverage rates are extremely affordable and amongst the most affordable historically experienced. It should be noted that it is an extensively held idea that term insurance is the least pricey pure life insurance policy coverage offered. One needs to examine the policy terms thoroughly to choose which term life choices are ideal to meet your particular situations.

With each brand-new term the premium is increased. The right to renew the plan without evidence of insurability is a vital benefit to you. Otherwise, the danger you take is that your health and wellness might deteriorate and you may be incapable to obtain a plan at the very same prices or perhaps at all, leaving you and your beneficiaries without protection.

You must exercise this choice during the conversion period. The length of the conversion duration will certainly vary depending on the kind of term policy purchased. If you transform within the recommended duration, you are not needed to offer any kind of information regarding your health and wellness. The costs rate you pay on conversion is usually based upon your "current obtained age", which is your age on the conversion day.

Under a degree term policy the face amount of the plan remains the same for the whole period. Typically such policies are sold as mortgage security with the amount of insurance policy reducing as the equilibrium of the home loan decreases.

Generally, insurance firms have not had the right to alter premiums after the plan is marketed. Since such plans might proceed for years, insurance companies must utilize conventional mortality, rate of interest and cost rate estimates in the costs computation. Flexible premium insurance coverage, however, permits insurance companies to provide insurance policy at reduced "current" premiums based upon much less conservative assumptions with the right to alter these costs in the future.

What Are the Benefits of Voluntary Term Life Insurance?

While term insurance policy is designed to provide defense for a defined period, irreversible insurance policy is created to give protection for your entire lifetime. To keep the costs rate degree, the premium at the younger ages goes beyond the real cost of protection. This additional premium develops a book (cash money value) which helps pay for the policy in later years as the price of protection rises over the premium.

The insurance company invests the excess premium dollars This kind of policy, which is in some cases called cash money worth life insurance, produces a financial savings element. Money values are vital to a long-term life insurance plan.

Occasionally, there is no correlation between the dimension of the money value and the costs paid. It is the cash money worth of the plan that can be accessed while the insurance holder is to life. The Commissioners 1980 Requirement Ordinary Mortality Table (CSO) is the present table utilized in calculating minimal nonforfeiture values and plan books for common life insurance policy plans.

What is What Is Level Term Life Insurance? Quick Overview

Lots of permanent plans will certainly have stipulations, which define these tax needs. Typical whole life policies are based upon lasting price quotes of expenditure, rate of interest and death.

Table of Contents

- – What Makes Voluntary Term Life Insurance Unique?

- – Why You Need to Understand Term Life Insurance...

- – How Does Level Premium Term Life Insurance Po...

- – What is Direct Term Life Insurance Meaning? F...

- – What Are the Benefits of Voluntary Term Life...

- – What is What Is Level Term Life Insurance? Q...

Latest Posts

Insurance For Loan Protection

Flexible The Combination Of Whole Life And Term Insurance Is Referred To As A Family Income Policy

House Insurance In Case Of Death

More

Latest Posts

Insurance For Loan Protection

Flexible The Combination Of Whole Life And Term Insurance Is Referred To As A Family Income Policy

House Insurance In Case Of Death